Maximising Security and Efficiency with CISO-as-a-Service

Many organisations are turning to implementing a CISO-as-a-Service option. The service is not only efficient, [...]

Unlocking the Potential: Exploring the Benefits of a vCISO

There is no doubt that the number of qualified and available cyber security experts is [...]

Hiring a Virtual CISO Verses a Full Time CISO Comparison

Most of us are aware that there is a huge gap of qualified cyber security [...]

PPI Principals of GDPR for Small Businesses: Navigating Data Protection

“So, all we have to do to implement these 11 chapters containing 91 articles in [...]

3 Triggers for Conducting a DPIA

Here’s a funny thing – recital 84 of the EU’s GDPR legislation states “…where processing [...]

Personal Data Deletion Done the Right Way

Are you managing personal data deletion correctly under the DPA and GDPR? Does everyone in [...]

Data Protection Officer Questions – Answered by a DPO

There are many questions about why a Data Protection Officer (DPO) is needed and what [...]

Data Protection by Design and Default Explained

Previously known as ‘privacy by design’, “data protection by design and default” has always been [...]

When Must You Complete a Data Protection Impact Assessment?

Data protection impact assessments (DPIAs) are a legal requirement for GDPR, to ensure people’s private [...]

MOVEit Attack – Security Tool Vendors Have Failed Us… AGAIN!

2023 MOVEit Cyber Attack to Affect the Masses Yet again, here’s a prime example of [...]

Cyber Security Supply Chain Challenges in the Agrifood Sector

Guest Contributor: Benjamin Turner, Former Chief Operating Officer, Agrimetrics Shortly after Russia’s invasion of Ukraine, [...]

Supply Chain Cyber Attacks & How to Prevent Them

“There has been a 742% average annual increase in software supply chain attacks over the [...]

Cyber Supply Chain Risk Management – Should Penetration Testing be Required?

Let us begin by describing how to approach Cyber Supply Chain Risk Management (C-SCRM) and [...]

Get WFH Cyber Security at the Forefront of Staff’s Minds

Is your staff is staying resilient with protecting company information assets whilst Working from Home? [...]

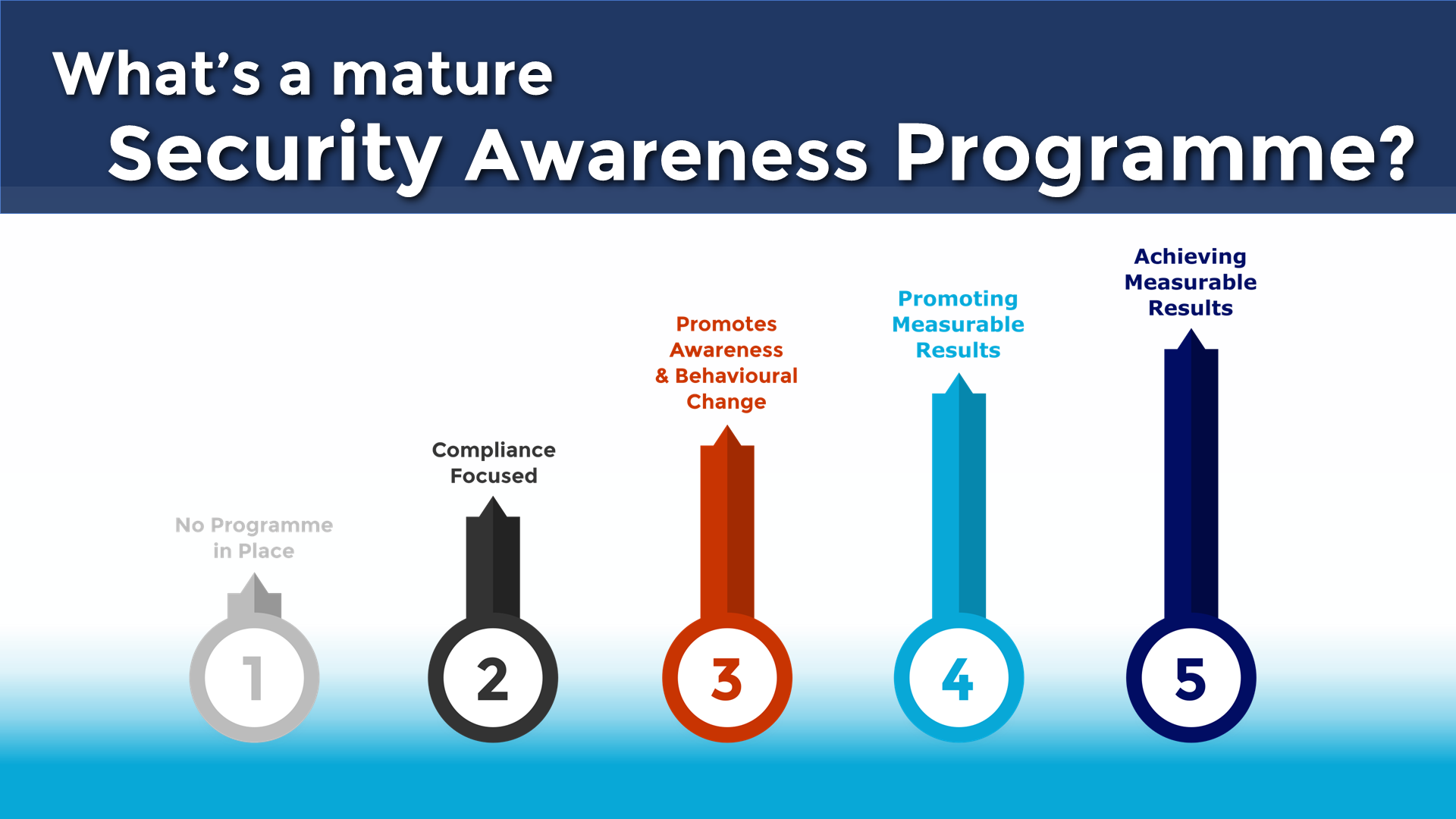

What’s a Mature Security Awareness Programme?

Good news. Bad news. The bad news is that cyber security threats to businesses are [...]

How a Ransomware Readiness Assessment Can Help Your Business Stay Safe

Ransomware is a type of malware that encrypts files and then seeks payment in exchange [...]

What is Ransomware? Four Examples You Should Know About

By now we all know the effect a Ransomware attack can have on an organisation. [...]

How to Outsmart the DarkSide Ransomware Group

The DarkSide Ransomware Group is one of the many gangs that continue to rebrand themselves [...]

Protecting Your Organisation After a Ransomware Attack

So, here is the scenario: you’re sitting at your desk working away and suddenly realise [...]

How Do You Conduct an Information Security Risk Assessment?

Information security risk assessments are crucial for any businesses that deal with any sensitive information [...]

SaaS Security 101: Essential Strategies for Businesses

Software companies have naturally embraced the cloud. It provides countless benefits for their clients, ranging [...]

As a nation, are we cyber security aware?

In the following blog post, we are going to shine a spotlight on the general [...]

How to Submit a Data Breach Breach Compensation Claim

What is a Data Breach Claim? “Someone stole my personal information and I want something [...]

How to Respond When Data Breaches Hit the Fan

Not many companies anticipate being the focal point of a significant data breach incident. However, [...]